More on beer & taxes & cash-strapped states

At the risk of sounding like Chicken Little, here's more talk on the topic of state governments in serious financial holes and looking at whose pockets they can raid without voter backlash ...

Pennsylvania beer writer Lew Bryson noticed in the Philadelphia Inquirer recently a letter to the editor urging the Keystone State to "substantially" boost taxes on beer, wine and liquor to help keep Pa.'s fiscal house in order.

The letter writer hails from a Philly 'burb, and we're going to assume that the individual is one of the everyday people, not someone with a temperance league calling behind his urging a bump in the sin tax in the name of salvation. (Worth noting: Goodman Lew didn't take the suggestion lying down and fired off a rebuttal to the Inky's opinion page.)

Anyway, here's where things lean toward scary: Joe Street-level urges his lawmakers to ramp up beer taxes, 'cause that product and its relatives deserve it. Lawmakers, with less than seaworthy vessels in choppy financial straits, may be inclined to listen to such mumbo-jumbo because it's not about the sales tax, nor income tax.

More scary: New Jersey's in stormy seas, and its vessel has a $2.8 billion gash in it right now, and that's just the current budget we're sailing under, never mind the one that has to be christened July 1 with an even keel.

Cap'n Corzine says we're taking on water and we're hard-pressed to find a port in this perfect storm, which includes an election year for the Garden State. Sales tax and income tax are historically hands-off territory anyway (barring that one sales tax hike Corzine bet his political career on in 2006), and they'll be doubly so in 2009. Though we haven't seen a beer tax hike pitched for the Garden State yet, that's no reason to think it's not on the table.

Reminder: The fiscal 2010 budget proposal goes public March 10th.

Summary: One of the engines that has conked out on the $$ New Jersey is the sales tax. Collection has sunk like a lead weight, our ship, like others, has been battered on the rocks of this recession (and ours was listing to begin with).

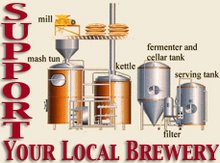

To repeat past posts: Think not of raising beer taxes, like Oregon has pitched and that fellow in Pa. who seems to think it's a capital idea. Instead, overhaul the regulations for brewers, meaning get behind them and help grow the industry, instead of standing in the way. Allow brewpubs to diversify their brewing, grant production brewers the same freedoms as wineries to sell retail. In short, raise revenue by having more brewers selling more beer, not by burdening the few, and ultimately us, the consumer, with higher prices.